IHA Mother Cabrini Scholarship Program

Frequently Asked Questions

How will scholarship awards be distributed?

IHA will distribute the funds via a check sent directly to the IHA member. It is then the organization’s responsibility to release the funds to the individual employee.

Can the scholarship award be split between more than one employee?

Yes, the organization has the discretion to divide the awarded amount in any way they see fit. The award can go to one employee, or ten employees, as long as all of the funds are being used to support employee education.

Can the employee be new to the organization?

This scholarship is available to both new and existing employees. You can use it as a recruitment or retention tactic.

Does IHA require any information about the award recipients?

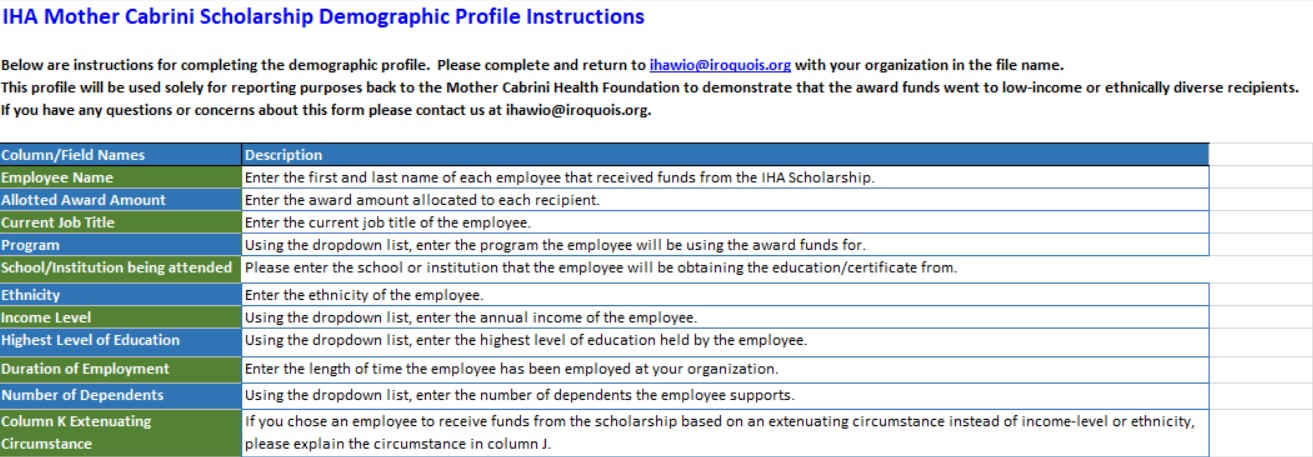

Yes, IHA will provide you an excel document that lists out all the required information needed for scholarship recipients. This information will be used to demonstrate to the Mother Cabrini Health Foundation how our grant funds helped vulnerable New Yorkers. We hope to use this data to extend the program and provide more scholarship funds next year.

You can view the information we collect in the sample picture below.

When will the employee information be due back to IHA?

The excel document will be due back to IHA on September 30, 2024. We will send email reminders about this closer to the due date. However, we do recommend that you will out the excel document as you select employees.

Organizations that do not submit documentation on time may lose the opportunity to receive funding in the future.

What can the funds be used for?

The funds can be used toward education in one of the following areas; RN, medical assistant, respiratory therapist, medical technician, surgical technician. Funds can be used to support tuition or books/supply costs.

Is there a deadline of when the scholarship funds must be spent?

The funds must be used for employee education taking place in 2024.

How will I know if an employee fits the eligibility criteria?

For an employee to be eligible for this scholarship they must meet ONE of the following criteria. 1. Low income/economically disadvantaged 2. Represent an under-represnted ethnicity or population OR 3. Have an extenuating circumstance.

1. IHA is not prescribing set guidelines to determine low-income criteria because this can vary by region. Organizations should be able to demonstrate to IHA that the employee is reasonably low-income or economically disadvantaged.

2. To represent an ethnic minority, the employee would fall into one of the following categories; Black/African American, American Indian or Alaska Native, Asian, Native Hawaiian or Other Pacific Islander, or Latinx. Employees that belong to other underrepresented populations such as those with a visible or invisible disability would also qualify.

3. For an employee to have another extenuating circumstance would mean that they do not fit into the above categories, but have outside factors that have made obtaining education difficult. This criterion is broad and can accommodate a wide variety of circumstances.

If you have questions about the eligibility of an employee, please reach out to us and we will help you determine.